Sole Trader – is it more tax efficient to incorporate?

Are you thinking of incorporating but not sure if it would be more tax efficient to do so?

The tax rules can be complex and not easy to understand when you are not an accountant, so in this blog we will look at the tax consequences for different levels of profit and savings through incorporating. We will also explain the other factors you need to consider before incorporating.

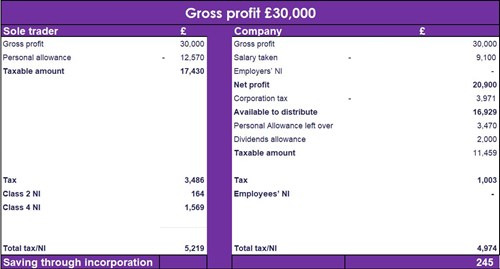

1. How much could I save by incorporating if I make a profit of £30,000?

The above calculation is based on 2022/22 tax rates and a minimum annual salari of £9,100 as recommended here .

What does this mean to you? You could save £245 by incorporating. However, you will also incur additional costs for running a limited company and your accountancy fees will increase due to additional reporting requirements.

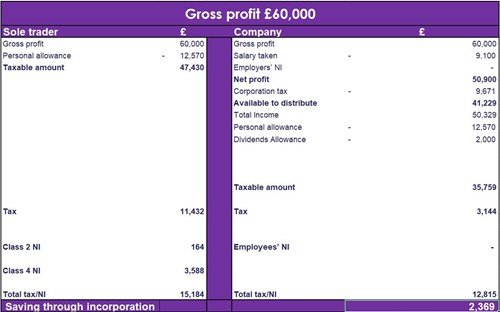

2. What if your profits increased to say £60,000. Would the results differ?

The savings would be significantly higher and as a general rule the higher the profit the more beneficial it would be to incorporate.

While you are self-employed, accounting fees are not tax deductible if they relate to the production of you HMRC Self-Assessment. You can claim expenses for your businesses accountancy fees, providing the accountant's time is being spent working on your sole trader accounts and not on personal items, such as the production of your HMRC Self-Assessment.

But there are other benefits of paying an accountant such as:

- Claiming additional eligible business expenses which you might be entitled to but you are not aware of

- More accurate returns and paying he correct amount of tax

- And more importantly, not spending time on bookkeeping and filling returns, but doing the things you love.

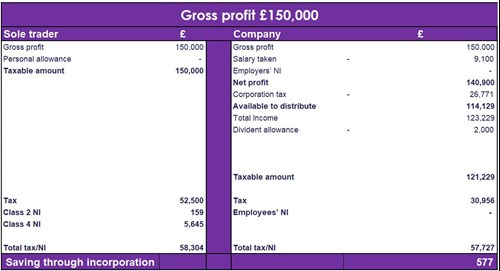

3. What if your profits are much higher, say £150,000?

As a sole trader, you would lose your personal allowance, as your taxable income exceeds £125,000.

If you incorporate, taking a salary would not make a massive difference due to the additional costs of running a payroll.

However, as a company director you can choose when to extract profit via dividend. You will only be taxed when the dividend actually arises. This means you can leave the profit in the company and not draw a dividend. Therefore you could save more in tax as opposed to a sole trader, who are taxed on the profit level, regardless of whether they draw the profit down for themselves or not.

The above cases are just for illustration purposes and your circumstances might be different, but we are happy to discuss any further questions you might have.

We can run a cost analysis to determine if it is more beneficial to incur more costs and pay less tax.

Get in touch

We can be next to you, every step of your journey, to meet your changing needs