Have you considered deductions and payments for National Minimum Wage compliance?

The National Living Wage increased by 6.6% (April 2022) from £8.91 to £9.50 per hour.

The rise means a full-time worker will get £1,074 extra a year before tax.

The rate depends on the age as per below:

- National Living Wage for over-23s: From £8.91 to £9.50 an hour

- National Minimum Wage for those aged 21-22: From £8.36 to £9.18

- National Minimum Wage for 18 to 20-year-olds: From £6.56 to £6.83

- National Minimum Wage for under-18s: From £4.62 to £4.81

- The Apprentice Rate: From £4.30 to £4.81

Really straight forward, right? But have you considered the deductions and payments made?

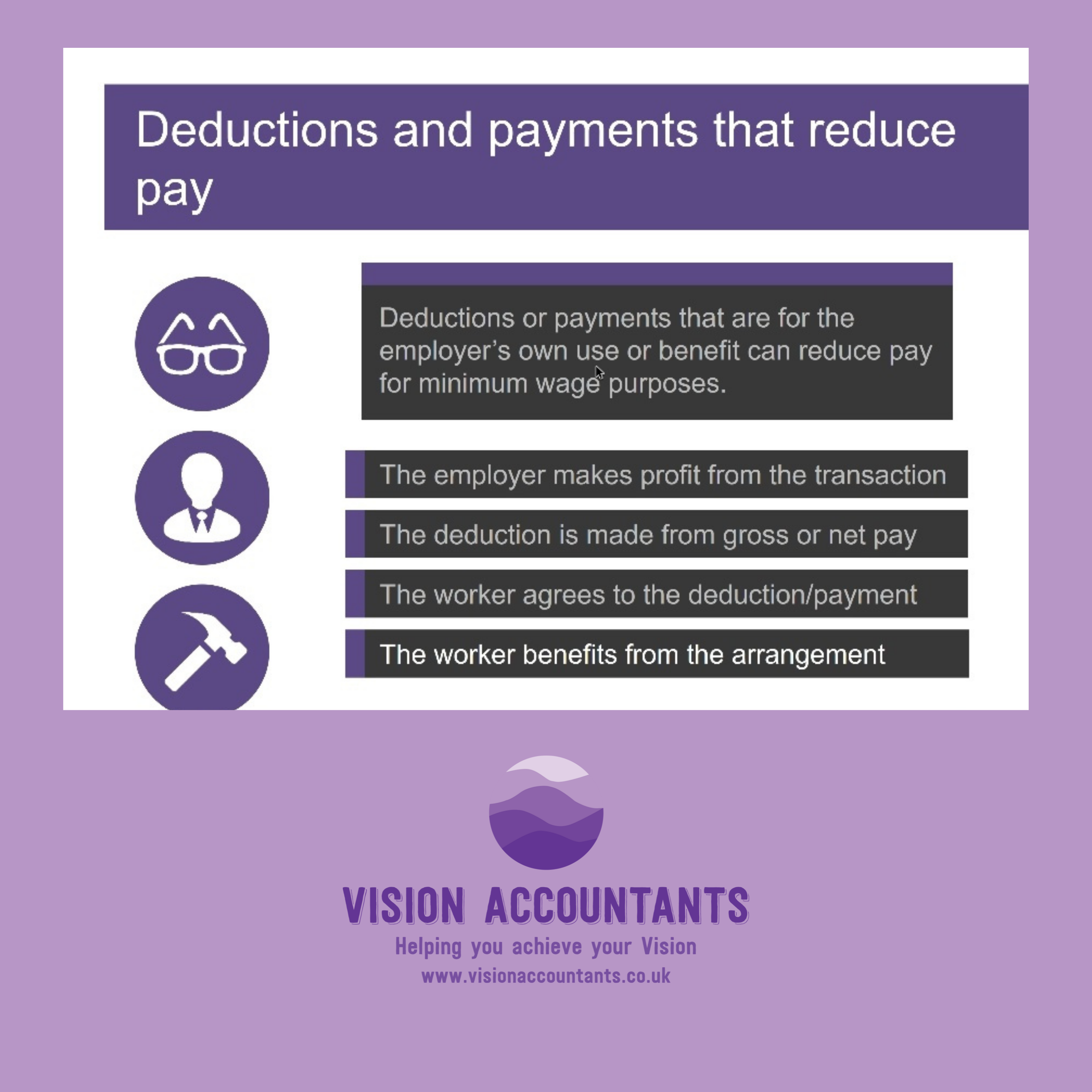

- Deductions and payments that reduce minimum wage pay

The following deductions or payments will reduce a worker's National Minimum Wage or National Living Wage pay.

- deductions for your own use or benefit

- deductions or payments from the worker to the employer for expenditure connected with the job - for example tools, uniform or travel costs - however if you refund the worker for these payments the refund counts as minimum wage pay in the pay reference period in which it is made

- payments by a worker to another person for things connected with the job - for example tools or uniform - however if you refund the worker for these payments the refund counts as minimum wage pay in the pay reference period in which it is made

- certain deductions from pay and payments by the worker for accommodation provided

You cannot make any of these deductions if making it would drop the worker's pay below the minimum wage rate.

- Deductions and payments that do not reduce minimum wage pay

When you make a deduction from a worker's pay, it will reduce minimum wage pay if it is for expenditure connected with the employment or if it is for your use and benefit.

However the following deductions from workers' pay and payments by workers connected with their employment do not reduce their minimum wage pay:

- deductions of income tax and National Insurance contributions (NICs)

- deductions from pay allowed under the worker's contract which relate to specific misconduct or payment by the worker of a specific penalty

- deductions from pay or payment by the worker because of an advance of wages or on account of an advance under an agreement for a loan deductions from pay or payment by the worker for purchase of shares or securities by the worker

- deduction from pay or payment by the worker to recover an accidental overpayment of wages

- deductions from pay that are not for expenditure connected to the worker's employment or for your own use or benefit

- voluntary payments by the worker for the purchase of goods and services from you - for example payments for meals the worker has freely chosen to buy in the staff canteen - but note a deduction in these circumstances will reduce National Minimum Wage pay

- certain deductions from pay and payments by the worker for accommodation provided

Here is an example for a case of misconduct where a deduction will not reduce the minimum wage pay:

As usual we are happy to go through any questions you might have at hello@visionaccountants.co.uk or .

Get in touch

We can be next to you, every step of your journey, to meet your changing needs